Florida — Best

Florida reigns supreme as the ultimate retirement destination, offering a trifecta of financial advantages, scenic beauty, and a wealth of recreational opportunities. The state's tax-friendly environment is a standout feature, with retirees enjoying the absence of estate, inheritance, and income taxes, ensuring their financial well-being. Notably, healthcare is affordable, with lower costs for adult day health care and homemaker services compared to other states.

Beyond financial perks, Florida's coastline, second only to Alaska, provides retirees with an idyllic setting for their golden years. The abundance of shoreline miles allows for leisurely beach strolls and serene days by the ocean. The state's commitment to recreational activities shines through its top-ranking status in adult volunteer opportunities, theater offerings, and access to golf courses and country clubs.

Florida — Best

Florida's dedication to seniors' well-being is evident in its low death rates for those aged 65 and older. Despite a relatively high overall cost of living, the state's comprehensive advantages make it the go-to choice for retirees seeking a harmonious blend of financial security, natural beauty, and an active, fulfilling lifestyle.

In essence, Florida stands as the unrivaled retirement haven, beckoning those searching for a retirement utopia. So if you're ready to retire, remember the Sunshine State!

Colorado — Best

Colorado secures its rank as the second-best state for retirees, offering a harmonious blend of tax benefits, social well-being, and exceptional healthcare. The absence of estate or inheritance taxes makes Colorado financially attractive for retirees, allowing them to maximize savings without additional financial burdens.

Beyond the financial realm, Colorado stands out for its low rates of social isolation among seniors, fostering a strong sense of community. With a minimal percentage of residents aged 65 and above living in poverty, the state prioritizes financial security, ensuring retirees can enjoy their golden years without economic strain.

Colorado — Best

Healthcare is a pinnacle of Colorado's retirement appeal, with top-tier geriatric hospitals dotting the landscape. The state ranks high in overall senior health and physical activity, demonstrating its commitment to the well-being of its aging population.

Colorado's dedication extends to recreational opportunities and community events tailored for retirees, creating a holistic retirement experience. In the cool embrace of the Rockies, retirees find not just a place to settle, but a vibrant community that values their financial, social, and healthcare needs.

Virginia — Best

Virginia claims the esteemed position of the third-best state for retirement, offering a multifaceted appeal to retirees. A primary draw is the state's robust elder-abuse protections, ensuring the physical safety and financial security of seniors. With top-tier geriatrics hospitals and a plethora of healthcare professionals, Virginia prioritizes the well-being of its aging population.

Financially, retirees find solace in the absence of an estate or inheritance tax, coupled with Virginia's rank as the tenth most taxpayer-friendly state. However, it's worth noting that while the state provides financial benefits, it doesn't boast the lowest cost of living.

Virginia — Best

Beyond fiscal considerations, Virginia's natural beauty enhances its allure. Miles of shoreline, a low violent crime rate, and commendable air quality contribute to a picturesque and secure retirement setting. This combination of factors makes Virginia an attractive destination for those seeking a balance between safety, healthcare, and financial advantages in their retirement years.

In summary, Virginia's third-place ranking as a retirement haven is justified by its commitment to elder protection, quality healthcare infrastructure, favorable tax policies, and an overall high quality of life. Retirees can find a secure and enriching environment in the Old Dominion State.

Delaware—Best

Delaware secures its place as the fourth-best state for retirement, propelled by a combination of financial advantages and a senior-friendly environment. Notably, the state boasts one of the lowest overall tax burdens in the nation, with the added perk of no estate or inheritance taxes. This financial friendliness ensures retirees can make the most of their savings, providing a solid foundation for a comfortable retirement.

A substantial senior population, comprising nearly 20% of residents, defines Delaware's demographic landscape. This not only fosters a sense of community but also contributes to the state's second-lowest risk of social isolation for seniors. Factors like living arrangements and economic stability are considered, creating an environment where retirees can thrive socially and emotionally.

Delaware—Best

Delaware takes a commendable lead in addressing the financial well-being of its older residents. The state boasts the lowest poverty rate among individuals aged 65 and older, a testament to its commitment to ensuring economic security for retirees.

In essence, Delaware's appeal to retirees extends beyond its picturesque landscapes. It offers a perfect blend of financial benefits, a vibrant senior community, and a commitment to social and economic well-being, making it a standout choice for those seeking a fulfilling and secure retirement experience.

Wyoming — Best

Wyoming comes in fifth place among the best states to retire, and one of the ways it stands out is by keeping seniors safe. Wyoming has very good protections against elder abuse compared to most states, as well as one of the lowest violent crime rates in the country and little crime overall.

It has some of the cleanest air in the country, too, which is a big help to seniors with breathing issues. Those wide open spaces work wonders!

Wyoming — Best

In the Equality State, retirees also tend to give back to their communities, as evidenced by one of the highest senior volunteering rates in the nation. This might help explain why there’s a low risk of social isolation for seniors.

When it comes to financial factors, Wyoming also ranks among the states with the lowest tax burdens and doesn’t have an estate or inheritance tax.

Idaho — Best

Idaho is a top choice for retirement due to its breathtaking natural beauty, low cost of living, favorable tax environment, and diverse amenities. The state's serene landscapes, including mountains, lakes, and forests, offer retirees ample opportunities for outdoor recreation and relaxation.

With reasonable housing costs and affordable essentials like groceries and healthcare, retirees can comfortably stretch their savings. Idaho's tax-friendly policies, such as no taxation on Social Security benefits and low-income tax rates, allow retirees to keep more of their income.

Idaho — Best

New Hampshire — Best

New Hampshire stands out as an excellent retirement destination for several reasons. Its breathtaking natural landscapes, including the White Mountains and serene lakes, provide retirees with a picturesque environment for outdoor activities year-round.

The state boasts a low crime rate and a strong sense of community, fostering a welcoming atmosphere for newcomers. New Hampshire is also tax-friendly for retirees, with no sales tax, no tax on Social Security benefits, and relatively low property taxes, allowing retirees to stretch their savings.

New Hampshire — Best

Additionally, the state offers a high-quality healthcare system, ensuring retirees have access to top-notch medical care and facilities.

Overall, New Hampshire's combination of natural beauty, safety, tax benefits, and healthcare quality makes it an ideal choice for those looking to enjoy their retirement years in a peaceful and comfortable setting.

Minnesota—Best

Minnesota—Best

Montana—Best

Montana—Best

Pennsylvania — Best

Pennsylvania stands out as a premier state in which to retire for several reasons. Firstly, its geography offers retirees a range of options, from serene countryside settings to bustling urban areas, catering to various lifestyles and preferences.

Additionally, Pennsylvania boasts a relatively low cost of living compared to other states, allowing retirees to stretch their retirement savings further and enjoy a comfortable lifestyle without breaking the bank.

Pennsylvania — Best

Moreover, the state is home to numerous top-notch healthcare facilities and medical services, ensuring retirees have access to quality healthcare when needed. Pennsylvania also offers favorable tax benefits for retirees, including exemptions on retirement income like Social Security, pensions, and distributions from retirement accounts.

Pennsylvania offers rich cultural heritage, diverse recreational activities, and proximity to major cities along the East Coast. Retirees enjoy exploring historical landmarks, attending cultural events, and outdoor activities. The state's charm fosters community while providing access to top amenities, making it an ideal retirement destination.

Illinois—Worst

Illinois—Worst

So what is it about the state that makes it a difficult place for retirees? The biggest problem for Illinois was its affordability ranking—they came in 47th for that specific category.

A lot of that probably has to do with the cost of living in Chicago. Quality of life has vastly improved in recent years, though healthcare could use some improvement as well.

Arkansas — Worst

Arkansas is in the same boat as other southern states. It’s fairly cheap, but the quality of life and healthcare are ranked low. In fact, Arkansas is ranked 49th in quality of life and 42nd in healthcare. Yikes!

That isn't to say that there isn't a single place in Arkansas that isn't worth its salt.

Arkansas — Worst

There are a few areas that seem to be flourishing — like the Fayetteville area. Unfortunately, other areas have a high crime rate, which isn't appealing to most people.

One of the few good things about the state is its beauty and the fact it doesn't tax social security income. The downside is that it does tax pensions.

Washington — Worst

Washington's not the dream retirement destination for several reasons. First off, the cost of living, especially in places like Seattle, is steep, with sky-high housing prices and unfriendly property taxes.

Then there's the weather—think gray skies and drizzle, which can put a damper on outdoor activities. Healthcare costs are another concern, with expenses adding up quickly, particularly for specialized care and prescriptions.

Washington — Worst

Taxes aren't exactly retiree-friendly either. While Washington lacks a state income tax, it compensates with high sales and property taxes, squeezing those on fixed incomes. Additionally, the lack of sunshine poses health risks, potentially impacting mood and well-being due to vitamin D deficiency.

Washington's allure for retirees might be overshadowed by its high costs, dreary weather, expensive healthcare, taxing system, and lack of sunlight. For those seeking affordability, sunshine, and tax-friendliness in their golden years, Washington might not fit the bill.

New York—Worst

While New York might be an enticing vacation spot, it's worth reconsidering if you're contemplating it as a retirement destination. New York finds itself towards the bottom of states to retire in, securing the 44th position.

Delving into the reasons behind this unfavorable ranking reveals that The Empire State's main setback revolves around its steep cost of living. In fact, New York landed in the very last place nationwide when it came to the affordability of living expenses.

New York—Worst

The challenges associated with New York's cost of living factor into its lackluster performance in the study. High housing prices, costly everyday expenses, and elevated taxes are among the factors that can strain retirees' finances. Unless you're financially well-equipped to navigate these financial hurdles, considering New York as a retirement location might not be the wisest choice.

However, if you're one of the extreme few who aren't worried about the cost of living, New York ranks relatively well when it comes to quality of life and healthcare, ranking 16th and 26th, respectively.

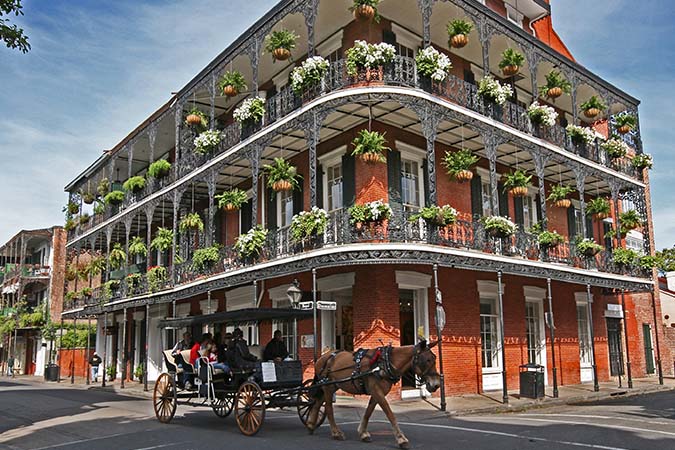

Louisiana — Worst

Louisiana — Worst

Oklahoma — Worst

When people think of Oklahoma the first thing that comes to mind is usually tornadoes. However, it's not the threat of severe weather that made Oklahoma such a bad place to retire—there are plenty of other things to worry about, too.

According to WalletHub, Oklahoma is only ranked 46th best for retirement.

Oklahoma — Worst

Oklahoma scored poorly in multiple categories for this study, including healthcare options and overall quality of life, ranking 45th and 47th, respectively. That means things like finding a job, finding friends, or finding a high-quality doctor could be an issue.

That being said, Oklahoma did much better in terms of affordability, so finances shouldn't be a big problem.

Rhode Island — Worst

Rhode Island — Worst

Rhode Island has some huge cons retirees should take into account. Healthcare is pretty good, but it's so expensive that most people can't afford it.

On top of that, Rhode Island is ranked last in transportation. It has some of the worst roads in the entire country, which takes a serious toll on vehicles.

Mississippi — Worst

Mississippi — Worst

New Jersey — Worst

New Jersey seems to be middle of the road on a lot of things — except affordability, which it ranks as the nation’s second worst state, just behind New York. Homes are not cheap here.

Urban congestion adds to the stress, while the lack of affordable recreation and cultural options diminishes the retirement experience.

New Jersey — Worst

Kentucky — Worst

Kentucky — Worst

In addition to its exceptionally poor healthcare, the cost of living is considerably higher than you’d expect in such a rural state. WalletHub places Kentucky as one of the worst places to retire because it's so expensive, and the quality of life doesn't match up with what you pay.

We're not sure how this happened, but just stay away. Kentucky is currently ranked as the absolute worst state to retire in.

Author

Courtney Holt

Last Updated: January 07, 2025

Author

Courtney Holt

Last Updated: January 07, 2025